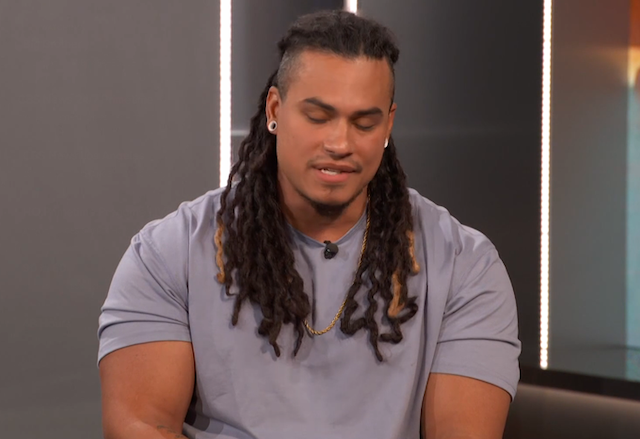

Keanu Soto’s run on Big Brother 27 ended Wednesday night when he was evicted 2-0 over Ava Pearl under the Head of Household reign of Vince Panaro. Despite warning Vince that taking Morgan Pope to the end would all but guarantee him second place, Vince stayed loyal to his Judges alliance with Morgan and Ashley Hollis, nominating Ava and Keanu for eviction. Morgan then won the Power of Veto and sealed Keanu’s fate.

Looking back on his game, Keanu admits his biggest challenge was himself. “If I ever play again, I’m going to have to get out of my own way,” Keanu tells Gold Derby. “I knew coming in here that my trusting nature was probably not going to be in my favour. I’m surprised I lasted so long. If I could go back and do it again, I would not have been so overly trusting — especially with Vince. How many times can I give someone a chance? He kept stabbing me in the back, and I just kept going back.”

That trust defined his closest relationships in the house. “Rachel felt like an older sister and Vince a younger brother,” he continues. “I truly did want to take Rachel to the end. If I were to win, it would have meant a lot more beating someone that had status already. I was hoping it would be us at the end. When she left, I was truly devastated.”

For Keanu, his dream finale always included Rachel. “I romanticised sitting next to Rachel. I wanted to beat a legend to become one. My only argument sitting next to someone like her — who had a great social game and was never on the block — would have been to make my resume so undeniable with competition wins that it would have been a no-brainer.”

Even in lighter moments, Keanu kept his sense of humor. When Zingbot compared his hygiene to that of an ogre, he laughed it off. “Any opportunity that I get to be compared to anything related to fantasy, I’m all for it!”

Despite the heartbreak of eviction, Keanu leaves proud of how he played. “My favorite and least favorite part of Big Brother was being singled out and targeted by everybody. I was able to prove to myself how resilient I could be and see what I’m made out of. I had a few slip-ups with houseguests that I’m not particularly proud of, but ultimately I felt like I handled it well. I came out a better person because of this experience. I’m proud of myself for that.”

For more updates on Big Brother 27, Live Feed spoilers, HOH Competitions, Eviction, and more, follow our Entertainment section and stay updated!

Like our Facebook Page: facebook.com/PostsAlways

Follow us on Twitter/X: @Postsalway x.com/Postsalways